|

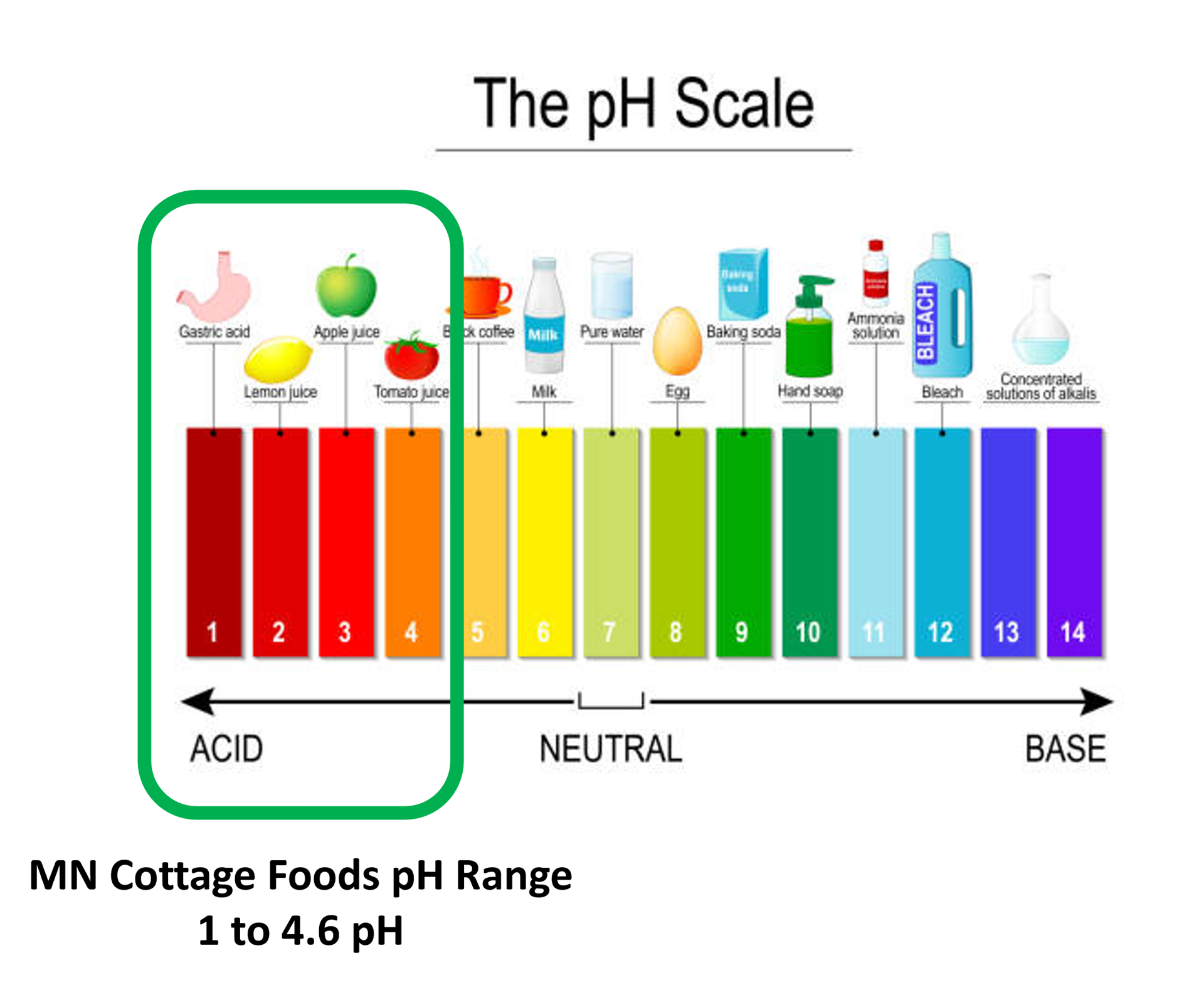

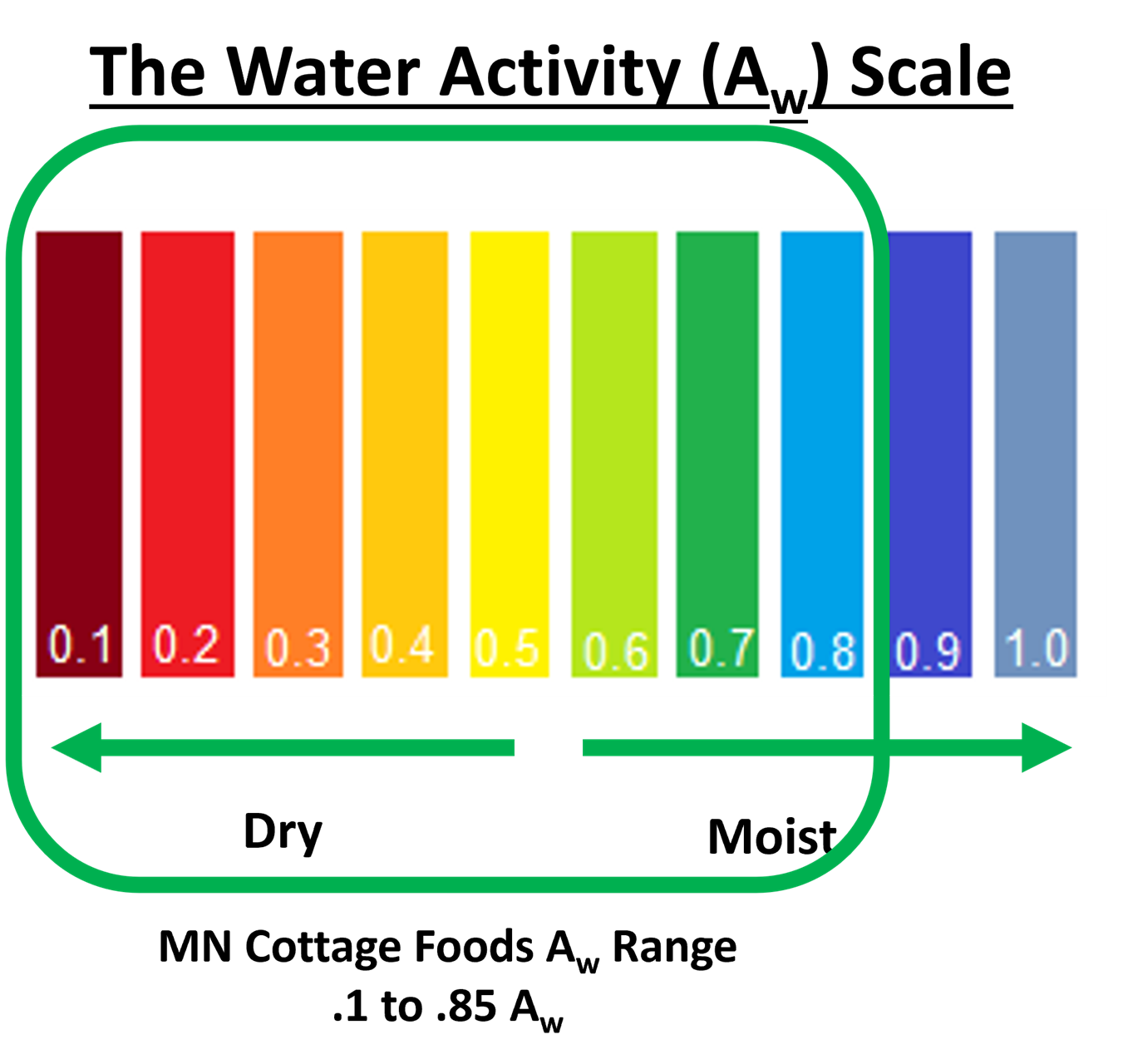

The MN Cottage Foods Law (Minnesota Statute 28A.152) was first passed in 2015, allowing for "non-potentially hazardous foods" (baked foods; certain pickled or canned foods; jams, jellies, etc.) to be made in your home kitchen without a license, as long as the cottage food producer (CFP) successfully completes the mandated food safety training and registers with the Minnesota Department of Agriculture. Prior to the 2015 CFL, was the 'Bread Bill,' and then the 'Pickle Bill.' The CFL has been amended a few times since 2015, the latest in 2025; those changes do not go into effect until August 1, 2027.

Feel free to read and download our cottage foods manual. (Email info@mfma.org if you need a paper copy.) It covers the following topics:

|

|

Get Registered! Free Cottage Foods Tier 1 Training, Test, Application Register here for MFMA's free Cottage Foods Training classes, all via zoom. You will learn the legal requirements & more, take the text, and complete the application. FEBRUARY

MARCH

APRIL

~~~~~~~~~~~~~~~~~~~~~~~~~ |